A useful starting point is to explore the background to the off-payroll working legislation (IR35), because the changes that came into effect in April 2021 will not affect the legal basis upon which IR35 decisions will be made, nor will off-payroll working alter the nature of the issue. What will change is operational, with the decision-making and liability moving up the contractual chain.

The Intermediaries Legislation, better known as IR35, was passed in 1999 and introduced by HMRC in 2000 and was aimed at individuals who were disguising themselves as employees to pay less tax.

IR35 has been contentious from day one and immediately faced an unsuccessful judicial challenge, but since then, has been subject to countless HMRC consultations, responses to consultations, clarifications, guidance, updates of HMRC manuals, changes in HMRC’s approach, parliamentary hearings, thousands of IR35 enquiries, tax cases and appeals, and more opinion and thought-leadership articles than you might ever have thought possible.

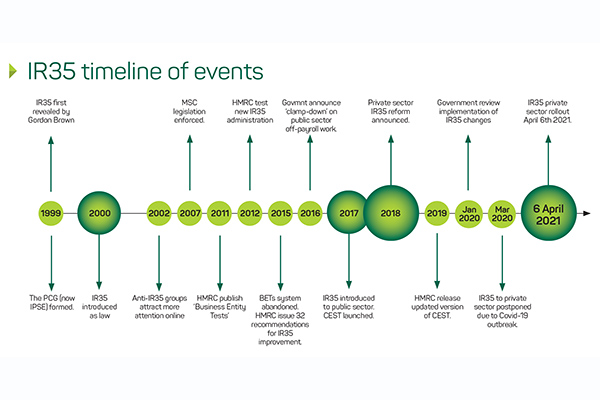

The IR35 timeline below shows the key dates since IR35 was announced in 1999

The aim of the legislation was to tackle certain individuals who were providing similar services to an employee but through their own limited company or partnership instead.

This form of tax avoidance doesn’t just benefit the contractor. Employers also benefit as this way of hiring workers means they don’t have to provide employee benefits or pay employers National Insurance contributions.

To be ‘inside IR35’ means that you are considered, for tax purposes, an employee of your end-client and therefore subject to PAYE. If you’re outside IR35, HRMC deems you as a genuine business.

However, the ambiguity of IR35 means many people find the legislation hard to understand. Combine this with HMRC’s history of IR35 tribunals not following much consistency, it would seem that even they seem to struggle with what exactly constitutes being ‘caught’ by IR35.

As part of the Budget of 1999, the Chancellor of the Exchequer had announced measures that would be introduced to counter perceived tax avoidance by using contractors engaged through their own limited companies, often referred to as personal service companies (PSCs). The problem for the Inland Revenue was that the engagement of individuals via a series of limited companies from end-client down – often via a recruitment agency – and their own PSC made it almost impossible to challenge instances of disguised employment.

The Intermediaries Legislation (taken from the consecutive Inland Revenue budget press release number 35) sought to tackle this issue, but rather than place the compliance burden and liability on the end-client, it placed both on the PSC, which is the “intermediary” of the Intermediaries Legislation.

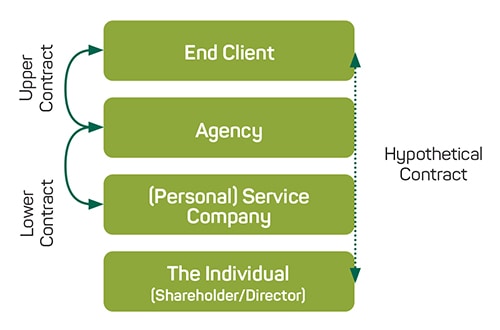

Below is a typical example of a contractual chain:

IR35 acknowledges that there is no direct contractual relationship between the worker and the client; IR35 seeks to create the hypothetical contract that would exist if the worker was engaged by the client directly, i.e. in the absence of intermediaries (the limited company and any agency).

If the hypothetical contract is deemed to create a “contract for services” (self-employment), the engagement is deemed to be “outside IR35” (sometimes referred to as “not caught by IR35”) and contractors working outside IR35, are entitled to receive payment in the form of dividends and claim business expenses, including travel and subsistence costs, not available to an employee, resulting in a significantly lower tax burden than their salaried counterparts.

If an engagement is deemed “inside” (or “caught by”) IR35, the tax position in the private sector until April 5th is that all bar 5% of the fees earned on that engagement will be treated as PAYE.

Travel and subsistence costs cannot be claimed (except in those specific circumstances where they could also be claimed by an employee) and the 5% is a nominal deduction to cover the running costs of the PSC.

Whilst it depends upon the fee income of the engagement, and the proportion of salary and dividends taken, the contractor will be financially worse off in an engagement which is inside rather than outside.

The change in responsibility for determining IR35 status.

Since inception of the legislation in April 2000, it has always been the responsibility of contractors to determine whether the relationship is genuinely one of self-employment or disguised employment.

However, by giving the decision to the contractor and HMRC perhaps not policing IR35 effectively to create a significant deterrent, it has become clear that the number of engagements deemed “inside” is nowhere near the level it should be.

HMRC have been seeking to act over the last 10 years to rectify the position. Only since the changes to what is now known as “off-payroll working” in the public sector in 2017 and the reaction to very similar changes that will affect the private sector from April 2021, have we seen a radical shift in the number of engagements either being treated as “inside” or becoming engagements under PAYE.

From April 2021, the IR35 decision-making burden in most cases will be transferred to the end-client, and the entity which pays the contractor’s PSC (the fee payer) will have the liability for ensuring the correct amount of tax is paid.

Who does IR35 apply to?

Private sector IR35, which goes live on 6 April 2021, affects all parties involved in the contractual supply chain including contractors, end-clients and fee payers, and agencies.

The April reform uses the off-payroll working rules that are currently in-force in the public sector and is seeking to ensure the same rules apply to both the public sector and the private sector.

This means that the end-client will be responsible for determining the employment status of the engagements it undertakes into with personal service companies (PSCs). The fee payer (typically the organisation paying the PSC) will need to deduct and pay tax and National Insurance contributions (NCCs) and pay any Employers NIC.

Who does IR35 not apply to?

HMRC have determined that small companies as defined by s382(2) of the Companies Act 2006) are exempt from making IR35 status decisions and this apparently removes 1.5 million companies from the requirements of the Off Payroll Working legislation.

Small companies must meet at least two of the following criteria:

- Turnover of no more than £10.2 million

- Balance sheet total of no more than £5.1 million

- No more than 50 employees

Whilst these small companies engage a very small proportion of the contractor population, their exemption from decision making means the contractor retains the responsibility for determining IR35 (and the liability for getting it wrong) after April 5th.

If you are engaged by small company, your PSC will be continued to pay gross and you determine how you will be remunerated. But it will be your responsibility to demonstrate due diligence and that your outside IR35 decision is based on an a proper assessment of the contractual terms and working practices, so it would be appropriate to have the engagement and even consider tax losses insurance.

Even if the independent assessment returns an inside decision, you will still have the benefit of the 5% notional relief for expenses, which is not available to those contractors whose IR35 status is determined by their medium and large sized end-client engagers.

Being engaged by a wholly overseas company

If your end-client is overseas with no UK presence, HMRC cannot compel a non-UK based entity to consider IR35 – irrespective of the organisation’s size – and your PSC as the first onshore intermediary is obliged to consider the IR35 status of the engagement. We would offer the same advice as a small company engagement: have your contract and working practices independently reviewed.

Caunce O’Hara offer a range of business insurance solutions to help contractors stay protected including Tax Enquiry & Legal Expenses Insurance, which provides cover for costs incurred by a HMRC investigation. Tel 0333 321 1403.

Markel Tax offer expert IR35 tax services and can help your business ensure it is compliant with the legislation. To speak to one of their experts please contact 0333 920 5708.