The results are in! Firstly, we’d like to say thank you to everyone who got involved in our IR35 survey, the response was fantastic.

Our survey was conducted throughout February and March, to help us gain a deeper insight into your thoughts and feelings about the controversial IR35 legislation that was rolled out to the private sector on 6 April 2021, and to discover what the ‘real world’ impact has been on contractors.

What you said in our contractor IR35 survey

The key point that stood out for us from the survey was that 60% of contractors reported their income had reduced due to the legislation.

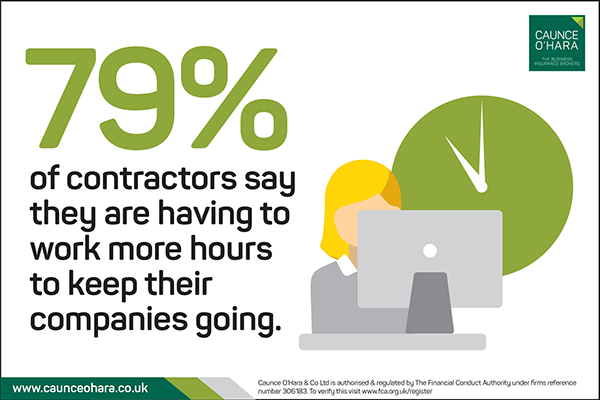

60% of respondents also said they had experienced a decrease in work opportunities as a direct result of the rule changes. Despite this decrease in opportunities, 79% of those surveyed said they were either working the same number of hours or more hours than previous years to keep their companies going and to maintain their quality of life.

One respondent said she previously enjoyed 52 weekends a year, but now she is lucky if she’s able to enjoy 10! She explained: “Previously I ran a company that had a good turnover, now I have to work for a contract inside IR35, then use my spare time to keep the company trading. So, I work at weekends and holidays as well to make sure my family is provided for, and the company remains trading.”

Despite this, she is hopeful the worst is behind them in terms of lower profits now that IR35 is a bit more stable, yet she says this is dependent on the government being willing to provide the necessary support. She also said she has seen past colleagues close their companies who are now working as full-time staff for private companies, as they have families to support and simply cannot afford to “argue” with the system.

What affect has end-client responsibility had on contractors?

As part of the reforms, medium-to-large private sector companies became responsible for determining whether the limited company contractors they engaged with should be taxed in the same way as salaried workers (inside IR35) or off-payroll employees (outside IR35).

In principle falling within IR35 would mean that contractors were also entitled to the benefits of PAYE workers. Yet, our survey found over half of those surveyed said they hadn’t received any benefits at all.

For one respondent, who works in HR & Learning, umbrella company benefits are one of the major issues with the current system. She told Caunce O’Hara, currently she pays tax at the same rate as an employee but with no benefits such as sick pay, holidays, or pension but with all the extra costs of running a business and the time commitment.

She went on to say that the biggest change the government could implement to make the system fairer is to “make it clearer for a company to identify the difference between inside and outside IR35”.

Of the respondents that had moved into umbrella companies or onto end-client payroll, the two most valued benefits of working this way were holiday pay and pension plans.

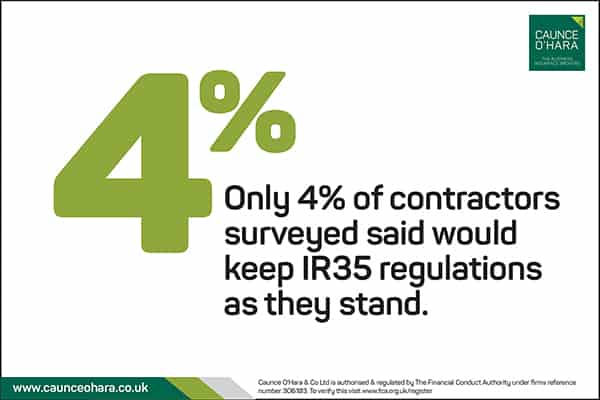

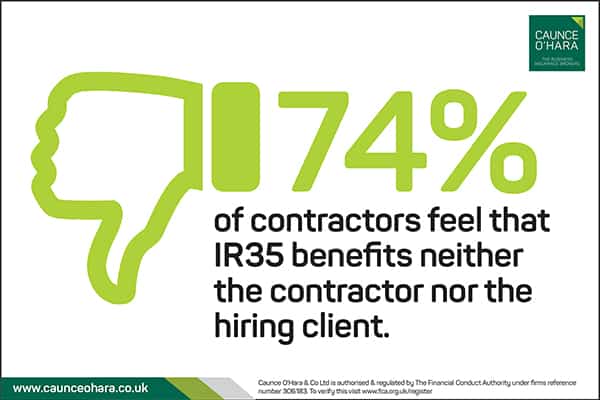

74% of respondents felt the system benefited neither the hiring business nor the contractor, with just 4% saying they would keep the regulations as they currently stand.

Are end-clients guilty of a lack of reasonable care?

Of those contractors we spoke to, over two thirds were currently engaged by either a public sector body or a medium to large organization, meaning the decision of where they fell within the reformed legislation was taken out of their hands.

And according to one IT contractor, some companies aren’t being fair. He told us how the company he was working for has a blanket ‘Inside IR35 or leave’ policy. He went on to say that many clients don’t want to “take the risk” of undertaking proper assessments.

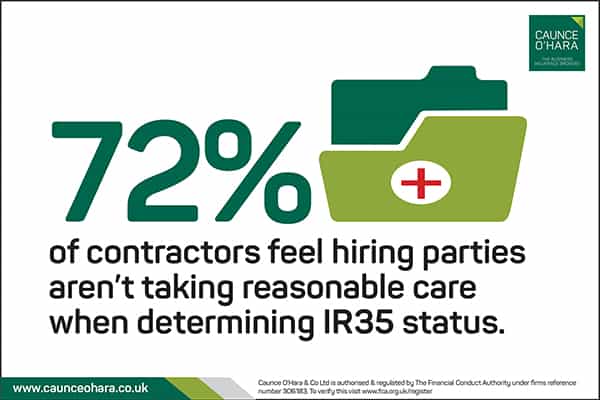

Rob Rees from Caunce O’Hara adds: “Six months ago, it was reported that six in 10 medium sized firms were operating without any IR35 off-payroll process in place, and our research suggests contractors are being impacted by this. Almost three quarters (72%) of contractors we spoke to felt that hiring businesses are not taking reasonable care when it comes to determining the status of an engagement.

“This, combined with the fact the majority of contractors are earning less and seeing fewer work opportunities, suggests few contractors have benefitted from the wide-reaching IR35 reforms one year ago.”

What is the state of the UK self-employed sector?

Up-to-date statistics from the Office for National Statistics (ONS) indicates an alarming drop in the number of registered self-employed professionals in the UK.

7 of the recent 8 quarters have recorded a drop in the number of self-employed professionals in UK. A total drop of 841,000 since Q4 in 2019 (5,025,000 registered self-employed) to Q4 in 2021 (4,184,000 self-employed) (1).

IR35 isn’t the only cause for this drop in numbers. Brexit and the Covid pandemic have obviously had their affects too. If markets continue to struggle, the cost of living continues to rise, and work opportunities for self-employed contractors continues to be reduced, then we can rightfully expect the figures for the self-employed in the UK to continue to decrease in 2022.

Further recent data from the ONS (2) on the current Labour force shows that the number of payrolled employees hit a record high of 29.5 million in January 2022. That’s a year-on-year increase of 4.8%, which equates to approximately 1.35 million people becoming payrolled employees since January 2021.

Any contractors who, in the wake of the IR35 reforms, opted to close their limited company to take on a permanent position or join an umbrella company would be included in this figure.

How else have contractors been affected by IR35?

It appears that IR35 has caused more than just financial issues for contractors. One respondent, who works in the technical engineering sector, told us: “It has made travel very difficult. I often work with colleagues who are full employees of a particular organisation and previously their admin staff would book me into the same hotel as those employees. I would pay the hotel directly so there was no financial involvement from the hirer.

“Now I have to wait until the team’s hotel has been booked and try to get into the same one. Similarly, for overseas travel I have to wait until the team’s flights have been booked. Again, I then have to try to get on the same flights so we can arrive at our destination at the same time. Unnecessary hassle.”

He went on to say that the biggest problem with the reforms currently is that many companies don’t understand the process at all and so are employing a ‘sledgehammer to walnut’ approach.

Summary

- 79% contractors surveyed said they were having to work more hours to keep their companies going.

- 74% of contractors surveyed felt the system benefitted neither the contractor nor the hiring end-client.

- 72% felt the hiring party wasn’t taking reasonable care when determining their IR35 status.

- 60% of contractors reported a drop in income from the previous year.

- 60% of contractors reported a drop in work opportunities as a result of IR35.

- Only 4% would keep the IR35 regulations as they stand.

- 7 of the recent 8 quarters have recorded a drop in the number of self-employed professionals in UK. A drop of 841,000 since the Q4 figures of 2019 (5,025,000 registered self-employed) to Q4 in 2021 (4,184,000 self-employed) (1).

Contractors and hiring businesses can find support for navigating IR35, including guides, news and contract review services at Caunce O’Hara’s IR35 Hub.

All quoted survey figures are based on the results of a Caunce O’Hara survey of 141 respondents conducted in February and March 2022.

Sources:

- https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/datasets/employeesandselfemployedbyindustryemp14

- https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/uklabourmarket/february2022#:~:text=Our%20most%20timely%20estimate%20of,0.1%20percentage%20points%20to%2021.2%25

Related Articles:

IR35 Guides – Written by the IR35 experts at Markel Tax