Electricians Insurance

Tailored trades liability insurance for electricians from only £7.36 a month

Start your quote

Cover for your business, staff, tools and equipment

Quick online quotes in less than 90 seconds

Rated 4.7 out of 5 by our customers on Feefo

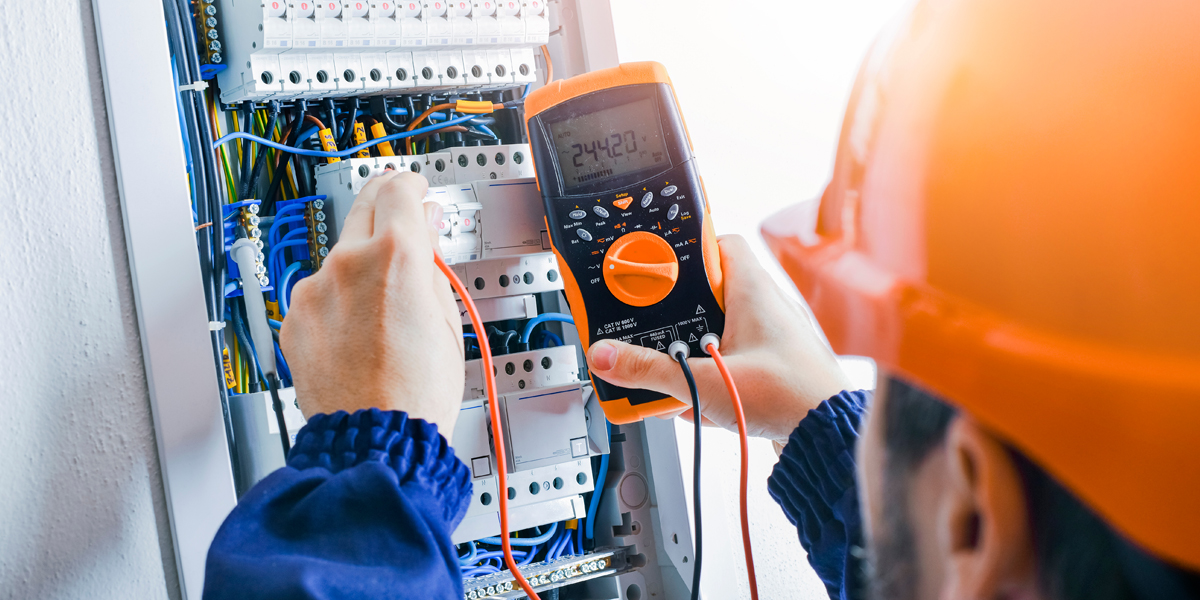

Caunce O’Hara tradesman insurance offers comprehensive industry-specific cover for a range of risks faced daily by electricians. Whether you’re working on electrical installations, rewires, repair works, conducting electrical tests or managing employees, our flexible insurance can keep you protected.

Start your quoteWhat is electricians insurance?

Working with electricity can be extremely dangerous. If something goes wrong with an electrical installation, rewire, or other electrical project, an error in any part of the work can prove to be very serious and in the worst case scenario it can prove fatal.

Our electricians insurance offers protection for a wide range of scenarios where a legal claim can be made against you and will cover legal fees and compensation awards involved with a claim.

Why do electricians need insurance?

A mistake in how you wire a home including sloppy work chasing wires and how you patch-up plasterwork afterwards, or leaving trades materials and equipment out on site for people to trip over, could lead to an accident and a potential liability claim against you.

If you are deemed responsible for an injury, you could be liable for high legal fees – and compensation payments to the claimant – that could have a significant impact on the finances of your business.

Our insurance can cover you against these scenarios and others, providing you with peace of mind so you can focus on your work.

Why choose Caunce O'Hara for your electricians insurance?

As trades insurance experts, we're your number one choice for your business protection.

Trusted by over 23,000 clients for their business insurance.

Immediate cover available, with documents issued via email in minutes!

Over 25 years’ experience of insuring self-employed professionals, including freelancers, contractors, and small business owners.

Relevant articles

Click on the relevant article below to continue

What our customers say about us

We are rated 4.7 out of 5 from 3,500+ reviews on Feefo.com

Frequently asked questions about electricians insurance

Electricians insurance provides protection for a many instances depending on which business insurance policies you hold, including:

Injury – Electrical work can create hazards that could cause injury to members of the public. For example, a customer may make a claim against you for a variety of reasons, such as being electrocuted from a faulty switch or from tripping over your work equipment or materials.

Property damage – Damage to your client’s property can range from something minor such as damaging a rug or plasterwork to something serious such as causing a fire in someone’s home due to faulty electrics you’ve worked on.

Tools and trade materials theft or damage – You park your work van on your driveway and head inside your home. Due to tiredness, and after a couple of hours updating your ledger and responding to customer enquiries, you forget to move your tools into the garage for safe keeping.

The next morning, you discover the van door has been prised open and your work tools have been stolen, which means you have to cancel your work for the day and replace your stolen tools.

Caunce O’Hara are specialists for trades insurance. These are just a few of the reasons to choose us for your cover:

Quick online quotes

By completing our simple online quote form you can get a quote in as little as 90 seconds.

Affordable protection

We have always strived to provide value for money for our clients. Our pricing is fully transparent, meaning you won’t be charged any hidden or unnecessary fees.

Platinum rated customer service

Looking after our customers has always been at the top of Caunce O’Hara’s priorities, which is reflected in our positive Feefo feedback.

Over 25 years’ experience

We have been offering business insurance to self-employed professionals since 1995. As a result we understand the needs of self-employed business owners and freelance contractors, which enables us to provide the cover you need.

The cost of an annual premium varies depending on your type of cover and the level of cover you need. Our trades public liability insurance for electricians starts from as little as £88.33 a year for £1miliion of annual public liability cover, which we think represents real value for money.

As well as public liability insurance for electricians, we offer a range of insurance covers for your individual circumstances, including:

- Personal accident insurance – covers you for accidents sustained in the course of your work and can pay a lump sum or regular payments to cover loss of earnings.

- Employers’ liability insurance (EL) – is a legal requirement if you employ staff, with a minimum of £5 million of cover to protect your employees.

- Tools insurance – available with our public liability insurance policy, provides cover from £1,000 to £5,000 for the replacement of your lost, damaged or stolen tools.

- Good in transit insurance – provides cover for your goods against theft, loss or damage while they are being transported in your own vehicle, or on your behalf by a third-party carrier. The policy can cover theft of items whilst in transit; damage caused by an accident during transit; loss of items during transit; and damage caused to items during transit.

- Plant insurance (PI) – we offer cover for both hired-in and owned plant equipment. Plant insurance can cover the costs incurred for ongoing lease hire for hired-in plant while the hired plant is being replaced, recovered or repaired, and can cover the cost of repairing or replacing owned plant following theft, loss or damage (accidental or malicious) to your equipment.

- Contract works insurance – cover for costs incurred in having to re-do work that is part of a contract, including the cost of the tools, materials and the labour, should the existing work be destroyed by fire, flood, or theft.

- Professional indemnity insurance (PI) – covers professionals who give advice, provide designs or other professional services to customers and covers allegations of negligent work.

The excess is the amount you pay towards a claim you make on your insurance policy. For example, if you make a claim for £1,000 for stolen tools and your excess is £200, then your payout will be £800.

| Insurance policy | Lowest excess | Highest excess |

| Public liability insurance | £250 | £250 |

| Employers’ liability insurance | £0 | £0 |

| Tools & trade materials cover (can only be purchased with the public liability policy) | £250 | £250 |

| Personal accident insurance | £0 | £0 |

| Professional indemnity insurance | £250 | £500 |

Please note the figures shown are for illustrative purposes only and any excess applied to your quote may differ.

Contact us

Call 0333 321 1403

Our understanding of the freelance sector and the challenges you face daily, enables us to tailor our insurance products to meet your needs. Contact us to talk about your insurance requirements and to better understand the insurance we offer.

Get in touch