2022 Spring Statement Summary

Posted on 24th March 2022 by Phil Ainley

Beginning slightly later than billed at 12:45pm, 23 March 2022, after a boisterous prime minister’s questions, the Chancellor of the Exchequer, Mr. Rishi Sunak, delivered his Spring Statement to the House of Commons.

It was a hotly anticipated speech given the state of the UK economy after the Covid-19 pandemic and the more recent problems surrounding the rapidly rising cost of living and the global fuel crisis.

The Spring Statement is not typically an occasion to announce major tax and spending decisions, but the recent squeeze on households due to rising bills was expected to force his hand to help people through this difficult time.

Personal finance expert, Martin Lewis, said the current “squeeze facing households was worse than during the Covid pandemic or after the financial crash of 2008” (1), he also stated that “political intervention” was required to ease the financial stress.

Mr. Sunak had said that he would not be able to “fully protect” people from the consequences of rising prices, but he did say he was prepared to step in and offer support with the caveat that “it’s not going to be easy.” (1)

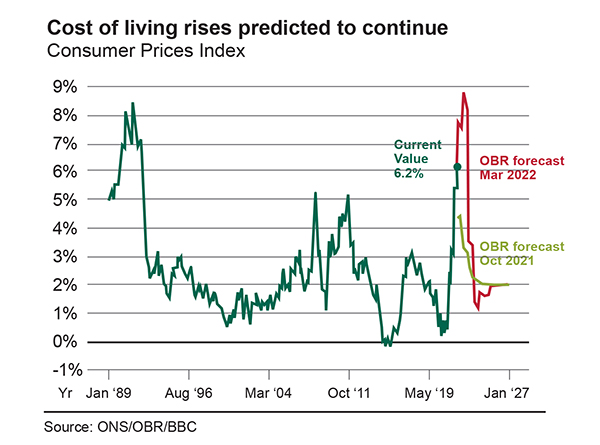

Millions of households face a huge hike in energy bills from April, when the government’s price cap is set to increase, some of which could leave households paying 54% more than they are currently paying. This rise is compounded by a further increase which is expected in October 2022 and the rising cost of fuel, which is pushing the cost of clothes and food up to an inflation rate heading towards 7%. In fact, prices rose by 6.2% in the 12 months to February 2022 – the fastest rise for 30 years (2).

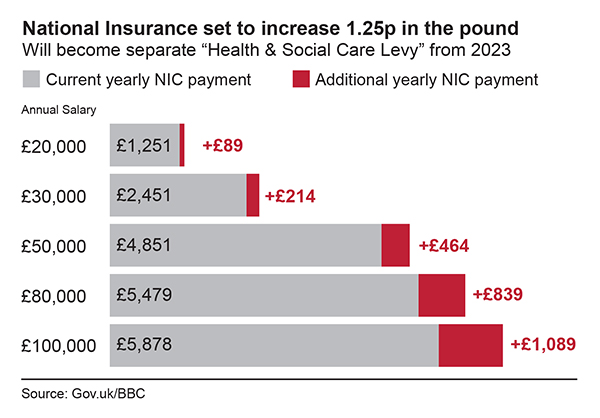

Despite calls from the opposition to scrap the 1.25% rise in National Insurance due in April, Mr. Sunak did not push the date back. After all, the cost of the Covid pandemic needs to be recouped.

Despite calls from the opposition to scrap the 1.25% rise in National Insurance due in April, Mr. Sunak did not push the date back. After all, the cost of the Covid pandemic needs to be recouped.

The chancellor had several options available to help the British people, but which of these (listed below) were really viable given the huge cost of dealing with the Covid pandemic and the financial uncertainty caused by the conflict in Ukraine?

The chancellor had several options available to help the British people, but which of these (listed below) were really viable given the huge cost of dealing with the Covid pandemic and the financial uncertainty caused by the conflict in Ukraine?

- Relief from green taxes

- Cutting fuel duty

- Top up universal credit

- Scrap National Insurance increase

- Freeze energy prices

- One-off “windfall” tax on oil and gas companies (2)

It has become clear to everyone in the UK that something needs to be done to protect the general public who are already struggling after the devasting impact of the Covid pandemic, whilst also providing continued support for businesses to ensure the economy doesn’t flatline.

We look at some of the key points of the Spring Statement and how they may affect you.

Firstly, let’s look at the state of the UK economy and public finances.

- According to the Office for Budget Responsibility (OBR), the economy is now forecast to grow 3.8% in 2022. That’s a huge cut from the original forecast of 6% growth.

- The UK economy is then forecast to grow by as little as 1.8% in 2023 and 2.1% in 2024.

- The annual inflation rate reached 6.2% in February, with the OBR expecting inflation to rise nearer to 7.4% for the rest of the year.

- Unemployment was at 3.9%, which is now predicted to be lower in each year of the new forecast.

- The chancellor says the UK’s underlying debt is expected to fall from 83.5% of GDP in the next financial year to 79.8% in 2026/27.

- In the next financial year, the UK is forecast to spend £83bn on debt interest, which is why the government must make “difficult decisions with the public finances”.

Fuel and energy

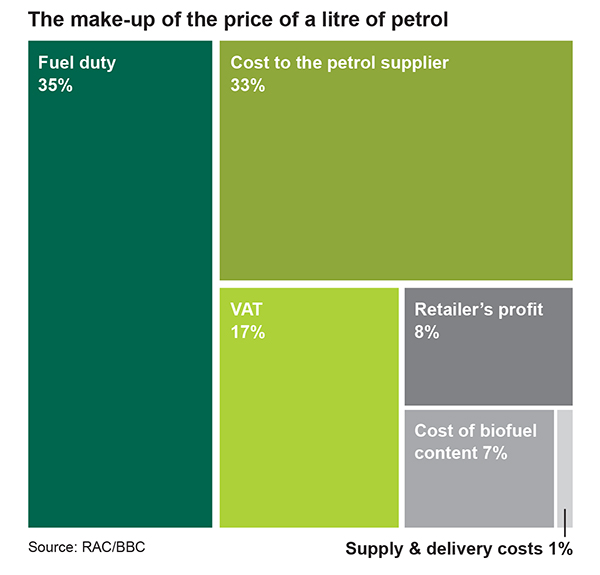

- Fuel duty will be cut by 5 pence per litre, from 6pm 23 March 2022. A measure that will be in place until March 2023. According to the RAC, this will cut approximately £3.30 off the cost of filling a typical 55-litre family car (4).

- Currently there is 5% VAT relief of the installation of energy saving materials e.g.: solar panels, heat pumps etc. Homeowners will now pay 0% VAT on the installation of energy saving materials, after Mr. Sunak announced he would scrap VAT energy efficiency measures.

Tax and National Insurance

- The chancellor announced the government will raise the threshold for the amount people earn before they pay National Insurance. Mr. Sunak says, “From this July, people will be able to earn £12,570 a year without paying a single penny of income tax or National Insurance”. He added, “The largest increase in a basic rate threshold ever, and the largest single personal tax cut in a decade.” This represents a tax cut of £330 per annum.

- The chancellor’s coup de gras was his final announcement, that for the first time in 16 years, the basic rate of income tax will be cut from 20% to 19% in the pound by 2024.

Help with the cost of living

- The chancellor says he wants to do more to help those who are more vulnerable by doubling the household support fund to £1bn.

Help for businesses

- Retail hospitality and leisure sectors will have a 50% discount in business rates up to £110,000.

- The Employment Allowance, which gives relief to smaller businesses’ National Insurance payments, will increase from £4,000 to £5,000 from April 2022.

Summary

There was a lot being asked of the Spring Statement, by the public and businesses alike. Whether Mr. Sunak’s measures make a positive difference remains to be seen.

Sources:

- I will help with costs where I can, says Chancellor Rishi Sunak – BBC News

- Spring Statement latest: Sunak to deliver mini-Budget to the Commons – BBC News

- Cost of living: What Tory MPs want from Rishi Sunak – BBC News

- www.bbc.co.uk/news/live/uk-60835481

How Rishi Sunak’s Spring Statement will affect you – BBC News

Spring Statement: Will Rishi Sunak help where it really hurts? – BBC News

Chancellor Rishi Sunak to deliver Spring Statement amid price pressures – BBC News

Spring Statement: Key points at a glance – BBC News

Related Articles: