Budgeting tips for small business

Posted on 7th July 2023 by Phil Ainley

Budgeting is an essential part of running a successful small business and managing your personal finances.

While the economy is struggling, and the cost of living is high and business running costs are high, having control over a watertight budget could be key to the survival of your small business, and to living in comfort.

We look at how you can create a budget and take greater control over your finances.

Budgeting for small business owners

When you start out, an outline business budget should be included as an integral part of your business plan. If you are already in business, you should already have a plan and a budget in mind, even if you are in your first trading year.

From paying your rent and purchasing essentials – such as printer inks, paper, toilet roll, tea and coffee – to marketing costs and tracking invoice payments, it is crucial that you stay in control of your finances. If you lose sight of your finances, your business could inadvertently find itself in financial hot water.

Budgeting is a good habit to form, but similar to most habits it might take a couple of months to form, so you will need to be patient until the habit sticks.

Storing and organising your receipts and invoices

There are many stories of small business owners storing receipts in a shoe box, then presenting the box and its contents to their accountant to sort out at year end. Needless to say, this is not an effective way to manage your business’s finances, and it could result in you being removed from your accountants’ Christmas card list.

Ensuring you have a system for organising your bills, receipts and invoices is crucial, as you will need this information at the end of the tax year.

Thankfully, the onset of digital has helped to make small business accounting a lot easier. Apps such as Xero, FreshBooks, Expensify, Wave, Smart Receipts and QuickBooks help to make recording your invoices and your expenditure quicker and less onerous.

Also, with the introduction of Making Tax Digital (MTD) which requires tax and VAT submissions to be uploaded digitally, the accounting apps help to make this process a lot easier and quicker.

Forecast your expenditure

Forecasting is important so you do not overspend in comparison to your income. Make sure you know when your bills are due and how much each is, including: rent for your business premises (if applicable), and other bills such as electricity and insurance. You will also need to estimate how much your expenses might be, such as fuel and parking if you go out to client meetings.

From this, you should be able to gauge how much you will be able to save plus how much money might be available for re-investment in your business.

Work out what your business budget will be

Figuring out how much income you need each month to survive is important. Once you know how much you need, you can set and monitor sales targets to ensure you meet your financial commitments.

It is important to ensure you allow for a savings contribution towards your taxes in your monthly figure, so you can pay your corporation tax and VAT (if applicable). Not factoring in savings for taxes is still a common mistake in businesses of all sizes.

Depending on your turnover and also how you prefer to monitor and pay your expenses, you may wish to track your budget either weekly or monthly.

At the end of each quarter and the end of the year, you can compare your financial tracking against your predicted sales and expenditure to see how accurate you were. This can help you plan for the following year’s finances.

Keeping a record of your transactions

Invoicing apps, think Xero or QuickBooks, to log receipts and invoices from your mobile phone help to make recording your transactions and invoices a lot easier, and on the go. You can also see at a glance whether you are on track or ahead of target, or if you’re behind your monthly target and need to rein in your spending.

Some people still prefer to work with a spreadsheet, and that’s okay, but bear in mind that you will need to be able to upload your transactions via digital means. Populating a spreadsheet usually means you will have to find time to input your transactions on your computer, which could mean extra hours after the working day has ended.

Creating and managing your balance sheet

The balance sheet provides a clear statement of a business’s assets, liabilities, and the equity of a business at a point in time.

The figures in the balance sheet can be used to calculate your equity (also known as ‘net assets,’ ‘net worth,’ or ‘capital’) using the following equation:

Assets – Liabilities = Equity

Company assets are the items owned or controlled by the business that help to generate income. Types of assets include:

- Current

- Non-current

- Physical

- Intangible

- Operating

- Non-operating.

These assets can include:

- Property

- IT Hardware

- Machinery

- Vehicles

- Furniture

- Inventory

- Investments

Correctly identifying and classifying the types of assets in a business is vital to the survival of a business, its solvency, and its associated risks. Accounting standards require companies to separate long-term or non-current assets (also known as ‘fixed assets’) from short-term or current assets.

Separating assets can look like:

| Non-current assets (fixed) | Current assets |

| Vehicles | Cash |

| IT equipment | Stock |

| Machinery | Debtors (customers that owe you money) |

| Property |

Liabilities are the company’s obligation to transfer money or services because of a transaction or prior event. This can be an invoice, the delivery of paid for goods or services to a customer, or to honour a warranty. Money that is owed to suppliers is known as payables.

As with assets, the liabilities should be separated into non-current and current liabilities.

- Non-current liabilities refer to amounts that are not due within 12 months, such as loans.

- Current liabilities refer to amounts due within one year such as business debts and other monetary obligations including supplier invoices, paid for goods that are yet to be delivered to customers, and bank overdrafts.

Separating liabilities can look something like:

| Non-current liabilities (long-term) | Current liabilities (short-term) |

| Mortgage | Creditors (suppliers you owe money to) |

| Loan | VAT owed to HMRC (if you are VAT registered) |

| Salary | PAYE and National Insurance (if you are an employer) |

Calculating your monthly budget

Many people like to work with Excel, which enables them to set up a monthly budget calculator, so they can monitor their outgoings and compare against their incomings in graphs and pie charts.

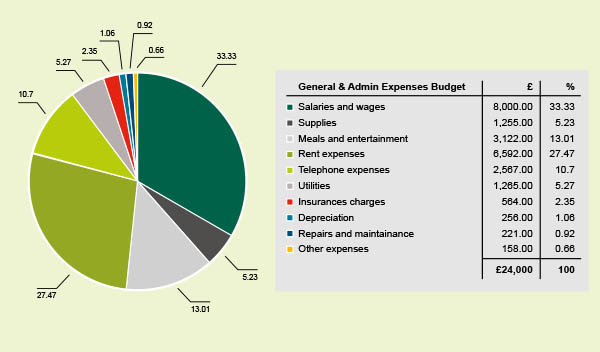

An example of a monthly expenditure could look like the pie chart below, which can show a business owner where the bulk of their expenditure is. This kind of information can help when it comes to looking for efficiencies in a business, which in-turn can help identify where savings could be made.

Download the small business budget calculator template

Five key budgeting takeaways to remember

- Get organised. No more storing receipts in a shoe box.

- Forecast, so you know what financial commitments are due each month.

- Workout your budget, so you know the sales volumes you need to make.

- Keep a record. Input your expenditure and invoices straight away so you do not lose track.

- Keep your balance sheet up to date, so you know what your business owns and what the business is worth at any given time.

Make sure your small business is insured, just in case

Whether you are starting out on a new business venture, or you are an established business, it is crucial to ensure your business is adequately insured.

Business insurance is a key item on your budget’s outgoings list, and the level of cover you need depends on your type of business, the size of your business, and whether you employ staff.

Seven key types of insurance that are relevant for small businesses include:

- Public liability insurance – A vital type of cover for small businesses who have contact with clients and the general public. It can cover legal costs for defending liability claims and pay compensation to a claimant if your business is found to be at fault for an accident that causes injury or property damage, providing you with peace of mind that your business will be covered.

- Office insurance – Whether you work in an office or from home, this insurance will cover your office contents including computers and electronic office equipment, furniture, stationery and documents whilst within your property. It is important to note that if you work from home, items owned by your business may not be covered under a household contents insurance.

- Directors and officers insurance – Many people believe they have no personal liability as a director or officer of a Limited company. In truth directors, managers and supervisors of any company can face allegations and claims for which they may be personally liable. Companies are protected by their liabilities insurances, but in many cases individuals are not; particularly if they have acted without proper authority or if they have breached (even inadvertently) part of the Companies Act 2006.

- Employers’ liability insurance – Employers’ liability cover is a legal requirement if you employ staff and covers the cost of defending or settling a claim against you from an employee who has suffered injury or disease as a result of the work they do for you.

- Cyber insurance – A cyber-attack is described as a deliberate exploitation of computer systems, technology-dependent enterprises and networks. Cyber insurance will provide cover for your business in the event of a malicious attack on your computer systems and your data by providing access to our cyber response helpline, as well as covering you for:

- The costs of restoring data and equipment

- Informing your clients of a data breach

- Meeting ransom demands

- Loss of your net profit

- Your legal defence costs and damages that you are legally liable to pay to other parties in the event of a cyber-attack.

- Professional indemnity insurance – Professional indemnity insurance is widely regarded as an essential type of business insurance if you provide advice, designs or a professional service to your clients.

- Legal expenses insurance – Expert cover for your business’s legal expenses costs incurred in the course of defending a claim that isn’t covered by indemnity or liabilities policies.

To find out what cover your small business could benefit from START YOUR ONLINE QUOTE with Caunce O’Hara today.

More useful small business guides:

An entrepreneur’s toolkit. Tips from business owners on starting and growing a business

Starting a business? Make sure you’re covered.

Sources:

https://www.caunceohara.co.uk/small-business-budgeting-tips-2018/

https://www.vertex42.com/Calculators/budget-calculator.htm

Useful Links

Professional Indemnity Insurance

Protects against claims of alleged negligence in your professional services, advice and designs.

Public Liability Insurance

Protects against claims of injury to third-parties or damage to a third-party's property.

Employers' Liability Insurance

A legal requirement for anyone employing staff. Protects your business in-case an employee is injured at work.

Cyber Insurance

Covers your business in the event of a malicious attack on your computer systems and data.