How to take time off from freelancing post birth

Posted on 12th March 2021 by Katherine Ducie

Manchester based freelance PR consultant Sara Teiger, of STPR, has had two children while maintaining a successful freelance business.

Sara is in fact one of many freelance mums juggling motherhood with running a business. Research shows that 14% of UK freelancers are working mums. That’s 605,000 freelancers in total – a 60% increase from 2008 (1).

With this substantial increase over the last decade, it’s clear that the flexibility of freelancing is ideal for many working parents.

While the benefits to choosing a career as a freelancer when you’re a parent are great, freelancing post birth can be difficult.

In comparison to taking a few weeks off for a holiday, taking time off after giving birth or adopting a child requires more careful thought and planning.

Knowing how to take time off, or rather how much time you should take off post birth, while maintaining your business, can be hard to figure out.

To help with this, Sara shares her experience of taking time off post birth and advice for freelance parents to be.

Questions we will cover:

- How much time should you take off work after having a child?

- How far in advance should you let your clients know you’ll be off?

- Should you keep in touch with your clients while you’re off?

- Should you still do your day-to-day freelance admin while on maternity leave?

- What do I need to prepare in advance of taking time off?

How much time should you take off work after having a child?

The amount of time taken off work post birth, greatly varies from freelancer to freelancer. Some freelancers might need to get back to work right away while others may decide to take a long-term career break.

Everyone’s personal circumstances are different and factors like finances and your family dynamic will impact how much time off you decide to take.

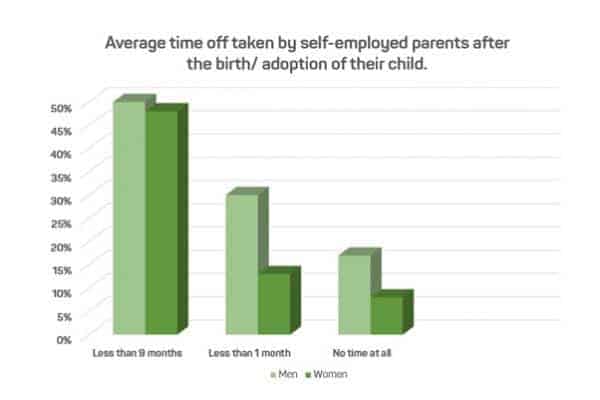

It’s estimated that freelancers take around six weeks of parental leave after the birth or adoption of their child (1). By comparison, UK employees are eligible for up to 37 weeks of paid leave, shared between the two parents.

Sara says: “With my first child, I retained one client throughout, sub-contracting the rest of my work to a freelance colleague. I had also let my work run down, by not taking on any new contracts as the pregnancy progressed. I gradually picked up more work as they got older and started part time at nursery.”

“With my second child, I took six months off and then gradually reintroduced work. From about one year in, I paid a friend to look after the youngest two mornings a week at my house, while the older child was at nursery. Once both were at school, I was able to up my hours, but even now when they are 12 and 9, I still work around the school day.”

Source: IPSE

How far in advance should you let your clients know that you will be off on maternity leave?

Sara says: “Clients knew I was pregnant and would be taking time off from about four or five months into the pregnancies.”

“I never had any negative feedback from clients about taking time off. Several sent me lovely gifts when my children were born and checked in with supportive emails whilst I was on leave.”

At this point, it’s also wise to let your clients know if you’ll be supplying a substitute in the interim.

Should you keep in touch with your clients while you’re off?

Sara says: “I didn’t initiate contact with clients during my maternity leaves because freelance colleagues were looking after the work, but I responded if they messaged to ask me how things were going.”

If you’re planning on claiming Maternity Allowance, it’s important to note that during your time off, you’re only allowed up to 10 ‘keeping in touch days’ with clients (2).

What if a client isn’t happy with the work a substitute provides?

Whilst your contract may allow you to send a substitute, the same contract may also make you liable for their work. If that work falls short of the client’s expectations, you could find that you are on the receiving end of a professional indemnity claim.

Having a professional indemnity insurance policy, which includes cover for a substitute person, will provide you with support including legal defence costs and the cost of putting right any errors.

It’s important to understand your contractual obligations when it comes to sending a substitute as there may be requirements around suitable notice to your client and additional insurance requirements.

What should I do if a client refuses a freelance substitute?

As a genuinely self-employed freelancer or contractor working through a limited company, it should be acceptable for you to provide a client with a freelance substitute who can provide the same service.

Having this clause in your contract is a key part of proving you are a genuinely self-employed contractor working outside IR35.

If a client refuses a substitute and wants you to personally carry out the work, point them to the clause in your contract that states your right to substitute.

Ensure that this clause specifies your right to find and provide the substitute yourself.

If a client still tries to refuse, Tax and Legal Expenses Insurance can provide cover for the cost incurred for many contract disputes and provide a legal helpline for the policyholder to contact.

Be wary that not being able to provide a substitute could suggest your working inside IR35, which could have tax implications.

Should you still do your day-to-day freelance admin while on maternity leave?

Sara says: “I really didn’t do any of this as there was no time or headspace. But nine years after the birth of my second child, I am busy and my freelancing is still going well.”

“Don’t put unnecessary pressure on yourself when you have a young baby. You can always pick things up again when the time is right.”

For anyone wondering, carrying out necessary administration for your business while claiming Maternity Allowance does not count as a keeping in touch day.

Sara’s top tips for freelancers on taking maternity leave:

- “Work as late as you can into the pregnancy. I was still finishing off a feature (ironically for a nursery magazine) during the early stages of my first labour!”

- “If you think that keeping on one client will help you to stay sane amongst the night feeds and nappy changes, then don’t dismiss it. I think it really helped me first time round to have something else to think about – and something that reminded me of life before becoming mum.”

- “Make sure you apply for Maternity Allowance. It’s not a huge amount of money but it made a big difference for me.”

Making preparations in advance

When it comes to preparing yourself financially, Sara says: “In the years running up to becoming pregnant I worked hard and could often be heard telling people that I was ‘earning my maternity leave’”.

“You do need to think about gathering a pot of money to see you through as Maternity Allowance alone is not enough.”

Here’s some other key preparations to consider:

- Find a substitute as early as possible, if you would like to subcontract your work while on leave.

- Give clients plenty of notice.

- Make sure you’re always factoring time off in your pricing, so that you can save.

- When you are 26 weeks pregnant, make your Maternity Allowance claim.

- Do your billing and pay any invoices ahead of being off.

- If you use social media to promote your business, use social media scheduling tools while you’re away to maintain your output.

To find out more about Sara, visit www.STPR.co.uk

For more information on how you can stay protected with Freelance Insurance, call our friendly team of experts today on 0333 321 1403, or click to get a quick online quote in minutes!

CLICK HERE FOR A QUICK ONLINE BUSINESS INSURANCE QUOTE

Related articles:

Preparing for Your Summer Holiday as a Freelancer

How to Prepare for a Sick Day as a Freelancer

Sources:

- IPSE webinar: Pregnant Then Screwed: What’s it like to be a freelance mother?, 25/02/2021

- https://www.gov.uk/employee-rights-when-on-leave