It’s a new tax year… so what’s changed and how will it affect limited company owners and SMEs?

Posted on 3rd May 2018 by Phil Ainley

April 6th 2018 marked the start of the new tax year, so what’s changed? Well a whole lot, including changes set out in previous budgets and statements and if you’re a SME, or the director of a limited company, then you really need to take note.

Dividend allowances fall

April 6th saw the 0% tax allowance for dividends fall from £5,000 per annum to just £2,000 per annum. So if you are a sole director of a limited company who withdraws money from the company in a mix of salary and dividends you will probably see your tax bill rise. Consult your accountant immediately for verification and for tax planning regarding this change.

How will this affect you in reality?

The following is an exmaple of a limited company owner who draws down a salary of £11,850 (the Personal Allowance) and dividends of £60,000 during the 2018/19 tax year.

- The £11,850 salary takes up the whole of the Personal Allowance

- The first £2,000 of dividends is included within the dividend allowance

- The next £32,500 of dividends are taxed at the Basic Rate of 7.5%

- The remaining £25,500 dividend is taxed at the Higher Rate of 32.5%

- So the total dividend tax liability is £10,725

- Plus £411.12 employees NIC and £472.79 employers NIC

- Total tax and NIC = £11,136.12

(The dividend allowance of £2,000 is tax free, but it still takes up £2,000 of your basic rate tax band £0 – £34,000 in 2018/19)

You can read more about the dividend allowance reduction here. <https://www.gov.uk/government/publications/income-tax-dividend-allowance-reduction/income-tax-dividend-allowance-reduction>

Pension contributions go up

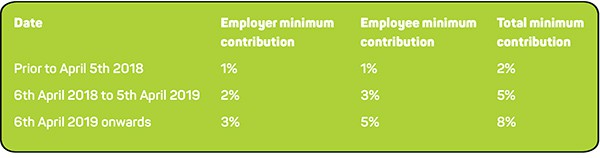

The new tax year also sees an increase in the minimum contributions for automatic enrolment pensions. The current combined minimum contribution of 2% has risen to 5%. This will rise again from 6th April 2019 to 8%. This needs communicating to your employees as there will be a rise in employee contributions as part of this. See below…

Both the employer and the employee can choose to pay more than the minimum contributions if they wish to.

The VAT registration threshold remains the same

As a rule the VAT registration threshold tends to rise with each new tax year, but not this time. The Autumn 2017 Budget held the VAT registration threshold at £85,000 for another two years. However, with inflation rising this represents a slight decrease in the threshold in real terms.

MTD on the horizon

Making Tax Digital (MTD) is a government initiative that sets out to make it easier for individuals and businesses to get their tax correct and keep on top of their finances. This could spell the end of the tax return for a lot of people.

MTD becomes compulsory from April 1st 2019 for all businesses that have to be registered for VAT. This means if you prepare your accounts up to 31st of March each year and you’re not yet using digital software for your bookkeeping, then this year would be the best time to switch so you have 12 months to get to grips with the new way of working.

Increases to rates and thresholds

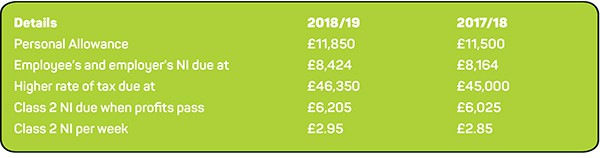

There are increases to your personal tax allowance to £11,850 pa and the amount you can earn before National Insurance becomes due rises to £8,424 pa. For higher earners there is also a rise before the higher rate of tax becomes due to £46,350 pa. See below…

Significant changes in Scotland

If you are a Scottish taxpayer you will be subject to more rates of income tax than the rest of the UK. See the table below…

The Personal Allowance has been reduced by £1 for every £2 of income over £100,000 pa. The new rates only apply to income not derived from dividends or savings income. So if you are a sole director of a limited company, you will pay tax on your salary at Scottish rates, but you will pay tax on your dividend at UK rates.

Read more about Scottish income tax in 2018/19 here.

HMRC confirmed that the Marriage Allowance will be given at 20% for both Scottish and UK based taxpayers.

Sources:

ITContracting.com

Gov.scot

Gov.uk

Freeagent.com

Related Articles:

Should I register my company for VAT?

Spring statement follow up – Contractors can breathe easy… for now