5 issues keeping contractors awake at night

Posted on 18th March 2019 by Phil Ainley

There are countless articles, blogs and whitepapers extolling the virtues of freelance and contract work over full-time employment. ALL of which appear to lead with ‘freedom’ as their main (and usually only) benefit.

Yet, let’s be honest now, working for yourself as a contractor or freelancer can be extremely tough. Contracting and freelancing comes with a lot more risk and uncertainty than you are ever likely to experience as an employee.

If you are new to it, you need to learn fast to ensure you thrive in your chosen industry.

Here are 5 of the key issues that contractors are currently losing sleep over;

IR35 tax reforms (private sector)

IR35 is tax legislation that is designed to prevent contractors working as ‘disguised employees.’ In a nutshell, it does this by taxing them at a similar rate to employment.

If you’re working as a contractor, but enjoy the same responsibilities as an employee, such as; control, benefits, managing staff – then you are NOT entitled to benefit from a different tax structure. You should therefore declare yourself as working ‘inside’ IR35.

If you are in any doubt as to your IR35 status, there are companies who provide contract reviews. They can help determine whether your contract places you ‘inside’ or ‘outside’ IR35.

To be ‘outside’ IR35, both your contract and your working practices will need to reflect that you are working as an independent contractor.

Late payment

The scourge of modern business and an abhorrent practice. Thankfully, the Chancellor announced steps in the recent Spring Statement to tackle the ‘late payments’ problem.

Late payments are rife throughout the business food-chain and have caused many closures over the years.

Contractors are especially exposed to this, a) because they sit at the bottom of the food-chain, and b) because they tend to operate from one contract to the next. This usually means they are operating from one income stream at a time.

To mitigate the risk, before you undertake and sign a contract, you could run a credit check on the client, recruitment agency and/or payroll company.

This will help clarify if your client can, and will, pay you on time for your services.

Finally, you should clarify and agree on your payment terms at the outset. This way you give your clients little or no excuse for paying you late.

Irregular work

While contracting can be lucrative, it can also be an uncertain and unpredictable career path to follow.

Depending on your skills set, you could be unfortunate to find yourself struggling with long breaks between contracts.

Long breaks between contracts could become more common after IR35 is introduced to the private sector as employers and engagers could potentially look to full-time employees to fulfil their requirements.

This will obviously put a strain on your finances, so it’s best to ‘make hay while the sun shines’, while you are working, and put money aside to ensure you can get through the leaner times.

Rates of pay

Hourly, daily, per length of the contract… there are many different pay rates that contractors prefer to work to.

The amount you can charge will depend heavily on your skills and experience, but ultimately the final say regarding what you are paid will be down to the client or end-user.

This means you could complete two or three contracts, performing the same tasks for different clients, and be paid two or three different rates.

Again, it’s best to ‘make hay’ and put money aside from your more lucrative contracts to see you through the contracts that are less well paid.

The future (after April 2021)

The ‘off payroll’ IR35 rules will be rolled out to the private sector from April 2020 onwards. This will directly affect a large number of private sector contractors and some engagers.

The onus will be placed on the engager to determine the IR35 status of the contractor. However, it is highly likely that the HMRC will still chase the contractor for any tax and NIC contributions due, with interest.

Only small businesses, of 50 employees or less, will not feel the impact of the April 2020 IR35 roll-out.

The question is, how will engagers approach the issue?

Some larger organisations may look to full-time employees as an alternative to contract workers. This could mean a shortage of opportunities and a skills surplus.

On the other hand, some contractors may even look to rejoin the employed workforce in an attempt to safeguard their futures.

Whatever happens, the IR35 rollercoaster still has a lot more ‘bumpy’ track to run across before things settle.

To find out how Caunce o’Hara can help contractors to navigate their way successfully through private sector reform click here to visit our IR35 Hub.

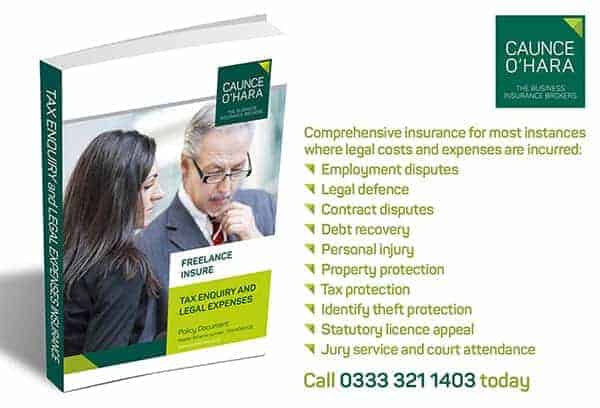

If you are unsure of your IR35 status, you can purchase a Tax Enquiry and Legal Expenses insurance policy along with a Contract Review here.

Related Articles:

Why you should include milestone payments in your freelance contracts

5 issues keeping contractors awake at night

8 classic mistakes that contractors make and how to avoid them