How to Prepare Your Business for Making Tax Digital

Posted on 1st February 2019 by Phil Ainley

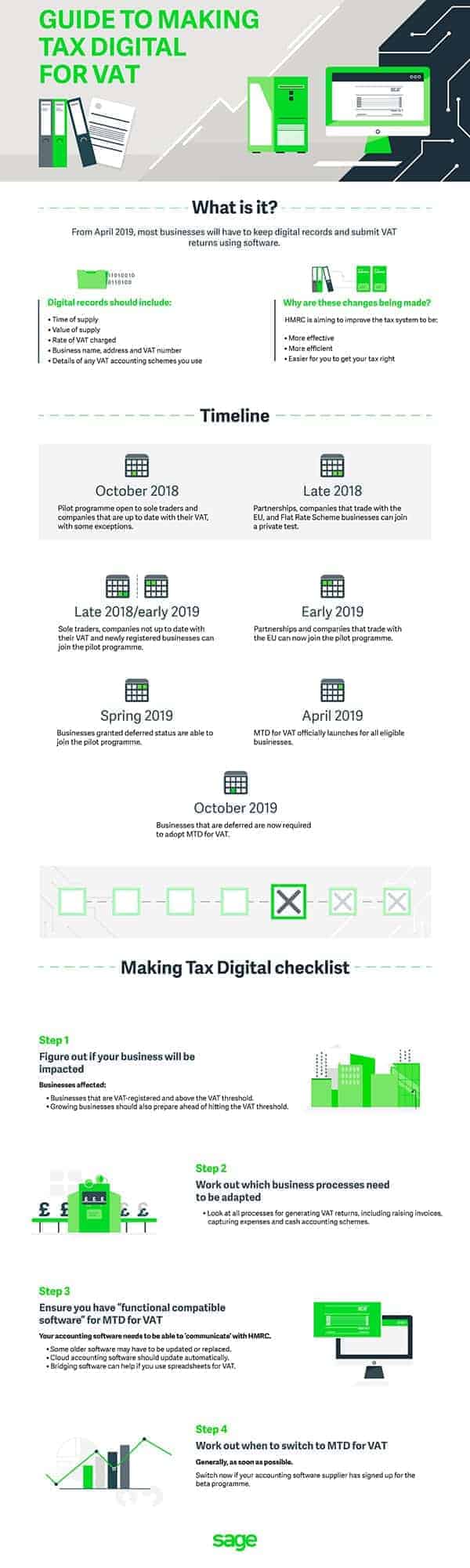

In April 2019, HM Revenue & Customs will introduce Making Tax Digital (MTD) its newly digitised tax system. This is an effort to modernise taxation, improve its own internal systems and minimise errors. While MTD is estimated to create £610 million in extra revenue for HMRC in 2020-21, many businesses are still unprepared for these changes.

What’s new about Making Tax Digital?

In basic terms, the new initiative requires all businesses who have a taxable turnover above the VAT threshold to:

- Digitise their VAT records and preserve them in a digital format

- Use MTD-compatible software to send VAT returns to HRMC

Your business will still be submitting the same nine boxes of information to HRMC but after April it must be completed using MTD-compatible software. This means that if you currently keep your VAT filing or record keeping on spreadsheets, these are unlikely to be suitable.

Additionally, all invoice details must also be kept in MTD-compatible software, meaning any paper-based notes or invoices will need to be transferred.

What do I need to do before the deadline?

If the thought of getting everything sorted by April has you worried, then you’ll be pleased to hear that HRMC have a “soft landing” period of 12 months. During this time, HRMC will accept a cut and paste of data as a digital link giving you some time to update your legacy tax systems.

No matter the size of your company, the changes brought about by HRMC’s Making Tax Digital are going have an impact on your business so it’s vital that you’re well prepared.

Thankfully, accounting software specialists Sage have put together a guide to Making Tax Digital for VAT to answer all your questions complete with a visual timeline and checklist below:

Related Articles:

How to ensure you get paid on time every time

5 ways to reduce your tax bill when self-employed

Disclaimer:

The information in this article has not been written by Caunce O’Hara & Co Ltd or any of Caunce O’Hara’s employees. None of the opinions or views contained within this article are Caunce O’Hara’s nor do we accept responsibility for any financial advice given within the article.

Caunce O’Hara & Co Ltd do not provide Life Insurance policies nor advice regarding Life Insurance or accounting and bookkeeping.